First-Time Homebuying Checklist

Historically, many individuals have accumulated the majority of their wealth through homeownership. It was often assumed that citizens who budgeted, planned, and worked diligently to buy a home would see an increase in their net worth after paying off their mortgage. However, there is a growing concern that record-high home prices and rising mortgage rates are making this path to wealth acquisition difficult for many demographic groups. Estimates indicate that U.S. home prices increased by nearly half during the pandemic alone. Reliable indicators, such as the home price-to-income ratio, support this narrative as well:

Source: Longtermtrends

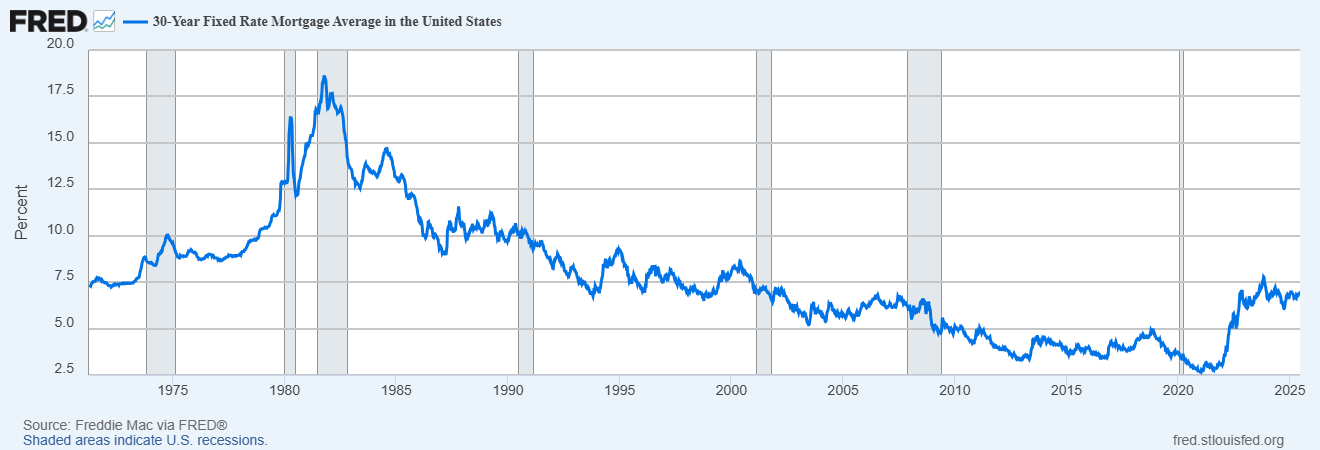

Despite the fact that home prices continue to hover near record highs, mortgage rates rose sharply from around 3% during the pandemic to around 7% by 2022. This means buyers are facing elevated prices combined with mortgage rates that are 3 to 4 percentage points higher than pandemic lows:

Source: FRED®, Federal Reserve Bank of St. Louis

Whether or not the goal of homeownership has become less attainable now than it was for previous generations is understandably a controversial topic amongst incumbents and those looking to enter the housing market for the first time. While these trends may create a sense of overwhelming anxiety regarding the subject, it is more important than ever to approach them with a well-informed perspective. This checklist is for those currently navigating the home-buying process, and provides a clear roadmap based on extensive research and experience. Despite current challenges, homeownership and its financial benefits remain attainable for those who act strategically. Therefore, I hope you will find value in the information provided below as you formulate your plan.

First-Time Homebuying Checklist:

1) Make sure you're as ready as possible...

- You have a stable source of income...

- Evaluate how stable and predictable your income is

- Consider whether you're in a high-growth career path

- If you're subject to income variability (Commission, freelance, etc.) you should be more conservative in home affordability estimates

- You've considered your long-term financial plan...

- Consider your other financial goals such as saving for educational costs, travel, retirement, etc.

- Ensure you can see yourself living in the same area for the next 5-7 years minimum

- Owning a home should complement, not cannibalize, your larger financial vision

- You're prepared for the extra costs and responsibilities which come with homeownership such as...

- HOA fees

- Maintenance and repair costs

- Property taxes

- Insurance

2) Estimate how much you can afford...

- Calculate the following ratios to determine the range of mortgage payments you can reasonably afford...

- Mortgage-to-Income Ratio (Conservative)...

- Keep your mortgage payment (Principal, Interest, Taxes, and Insurance) under 25% of your monthly take-home pay

- This is a guideline recommended by Dave Ramsey

- Mortgage-to-Income Ratio...

- Keep your mortgage payment (Principal, Interest, Taxes, and Insurance) under 28% of your monthly gross income

- Exceeding this may leave you house-poor, with limited funds for savings, investing, or lifestyle needs

- Debt-to-Income Ratio...

- Keep your total debt payments (Mortgage, car loans, student loans, credit cards, etc.) under 36% of your monthly gross income

- A higher DTI ratio can hinder your ability to qualify for other loans, save aggressively, or weather income drops

- Mortgage-to-Income Ratio (Conservative)...

- Enter your ideal mortgage payment amount into a home affordability calculator along with your...

- Income

- Monthly debt payments

- Available cash for a down payment

- Use your maximum home price to calculate what your Home Price-to-Income Ratio would be...

- The price you pay for the home should generally not exceed 3 times your gross yearly income

- In high-cost areas, some may stretch to 4–5x, but only if balanced by low debt and high savings/investing rates

- A higher multiplier stretches your budget, especially in volatile markets or during periods of rising interest rate

3) Prepare your finances for a mortgage...

- Improve your credit...

- Avoid opening new accounts

- Address your credit utilization rate (Optimally below 30%)

- Request your credit report from all three credit bureaus (Equifax, Experian, and TransUnion) and dispute any inaccuracies

- Get to at least a 620 FICO score to get approved for most conventional loans (The higher your score, the lower your mortgage interest rate may be)

- Aggressively pay down debt and begin saving any remaining cash in an account which is separate from your checking...

- Keep these funds in an FDIC-insured High-Yield Savings Account (HYSA) or a Money Market Account (MMA)

- Never plan to deplete your savings entirely in order to afford the purchase of a home as it leaves you vulnerable to unpredictable events such as job loss or unexpected repairs

- If you are planning to supplement your home purchase savings with a gift from a third party, ensure that you adhere to any special requirements such as providing the lender with a "gift letter", etc.

- Be prepared to get creative about ways to offset the costs of homeownership...

- Learn how to perform more of the home's maintenance and repairs yourself

- Look into remote jobs that would allow you to work from home

- Find a roommate or consider "house hacking"...

- Renting out part of the home (Basement, extra room, ADU, duplex) to offset mortgage payments

- If done strategically, this can dramatically improve affordability and wealth-building potential, even if the purchase price exceeds traditional limits

4) Save a realistic amount...

- Down Payment (At least 3% of your home's purchase price)...

- Some programs allow as little as 3–5% down, but this does increase long-term costs and risk

- Putting 20% down avoids the need to pay for Private Mortgage Insurance (PMI) and improves loan terms

- A larger down payment also reduces your loan size and monthly payments (This helps you qualify more easily and could positively influence future borrowing power)

- Earnest Money (Approximately 1% of your home's purchase price) - Deposit that a buyer pays to a seller to show their commitment to purchasing a property (Usually applied to the down payment if the sale goes through)

- Option Fee (Approximately $150-$500) - Payment made by a buyer to a seller that gives the buyer the right to terminate a contract within a set period of time

- Inspection Fee (Approximately $300-$500) - Cost you pay to a professional home inspector to thoroughly examine a property before purchasing it

- Appraisal Fee (Approximately $300-$500) - Cost to have a professional appraiser create a report on a property's value

- Closing Costs (Approximately 2-5% of your home's purchase price)...

- Loan Origination Fee

- Prepaid Property Taxes

- Title Insurance

- Recording Fees

- Underwriting Fees

- Real Estate Commissions

- Emergency Fund (3-6 months of projected living expenses) - You can calculate this by creating a budget which includes your current average monthly expenses plus your expected monthly expenses related to your new home...

- Mortgage Costs

- Maintenance & Repair Costs (It's recommended to budget 1–3% of the home’s value annually for these costs)

- Moving Costs (Varies)

- Renovation Costs (Varies)

5) Create your "Homebuying Wishlist"...

- Research different markets, neighborhoods, and home styles while keeping in mind resale potential, which can be estimated by observing the...

- Average number of days a listing stays on the market

- Historical price appreciation

- Rental demand

- Identify your non-negotiables versus your wants...

- Location...

- Low crime rates

- Clear of flood zones

- Within high-quality school districts

- Close proximity to main roads, public transportation, and places of work

- Preferably areas with unrestrictive zoning and upcoming projects which can influence value

- Community amenities (Outdoor spaces, fitness facilities, pet-friendly areas, and convenient services)

- Number of bedrooms and bathrooms

- Available storage and parking

- Appliance quality

- Square footage

- Natural light

- Yard size

- Location...

- If you intend on "house hacking" to help make the costs of homeownership more affordable, you should consider additional factors such as...

- Multifamily vs. Singe-Family properties (Duplexes, triplexes, and Accessory Dwelling Units (ADUs) are ideal)

- Neighborhoods restrictions (HOAs can sometimes deny non-owner occupancy or short-term rentals)

- Local zoning and occupancy laws around rental units and unrelated individuals living together

- Multiple bedrooms (Or areas which can be easily converted)

- Septic/sewer limitations

- Overall square footage

- Secondary entrances

- Extra utility hookups

- Finished basements

- Rental potential...

- Cash flow (Estimated future rent minus expenses)

- Cap Rate and ROI (A common rule of thumb is to aim for at least a 5-10% return)

- Demand and comps (Estimate rental income using platforms such as Rentometer, Roomies, and Zillow)

6) Assemble your network of trusted professionals...

- Find a trustworthy real estate agent you can communicate with about...

- Finding the up-and-coming neighborhoods

- Comparing the pros and cons of various homes

- Navigating the preapproval process

- Whether an asking price is appropriate

- Negotiating with sellers and handling potential bidding wars

- Submitting paperwork and preparing for closing

- Inquire about a preferred mortgage company that the agent has worked with and trusts

- Consider hiring a real estate lawyer (They are not required in every state, but they can be useful if you end up in a complex legal situation)

7) Explore your mortgage options & Get preapproved...

- Gather the necessary documentation...

- Previous addresses and current landlord’s contact information

- Bank and investment account statements from the past 90 days

- Proof of employment (Including previous 2 pay stubs and tax returns)

- Request and compare quotes from multiple lenders...

- Compare them based on important aspects such as the mortgage rate...

- Higher mortgage rates reduce how much house you can afford

- A 1% difference in rates can equate to hundreds of dollars per month in payments

- Use a fixed-rate mortgage if you want predictability and stability (Adjustable-rate mortgages (ARMs) may seem cheaper upfront, but carry future risk)

- Don't worry about multiple applications negatively effecting your credit score as any mortgage applications you make will only count as one inquiry if done within a 45-day period

- You may qualify for a variety of first-time homebuyer loans that offer low or 0% down payment options including those from the...

- Federal Housing Administration

- Department of Veterans Affairs

- Department of Agriculture

- Compare them based on important aspects such as the mortgage rate...

- Look into assistance programs that offer down payment and closing cost funds you don't have to pay back

8) Make an offer...

- Consider factors such as...

- Whether offers have already been made on the house

- The state of the housing market (Nationally & Locally)

- How long the house has been on the market

- Appliances to be included

- Repairs needed

Your offer should be made with the specific contingencies in mind such as... - The need to negotiate if necessary

How soon you need to be in the house Whether you need to sell your current home to buy this one

- Be ready with your...

- Earnest Money

- Option Fee

- Inspection Fee

- Appraisal Fee

9) Schedule your home inspection (You should expect to pay for an inspection within 3-5 days of an accepted offer, and before the mortgage company schedules an appraisal)...

- You will get a list of items that are damaged or need a safety upgrade

- This could affect whether you want to move forward or change your offer so it can be used as a negotiating tool

- You should accompany the inspector for their home walk-through while taking notes and pictures of the age and condition of major systems...

- Plumbing

- Electrical

- HVAC

- Foundation

- Roof

10) Order a home appraisal (Mortgage lender does this after accepting an offer on a home)...

- A third-party appraiser will determine the home's fair market value based on the characteristics of the home and the market

- If the appraisal comes in at or above the offer you made, you can move forward to closing

- If the appraisal comes in at less than the offer you made, you'll face a problem with your lender as they won't approve a loan for more than the house is worth, and there will be 3 potential options to be negotiated...

- The buyer pays the difference

- The buyer and seller split the difference

- The seller comes down in price

11) Prepare for closing...

- Get homeowners insurance (You will need to show proof of coverage at closing if you finance your home with a mortgage)

- Perform a final walk-through of the home...

- To ensure the negotiated repairs have been performed and that everything is in working order

- If you plan to make renovations after closing, request the current owner’s permission to shop around for contractors, painters, carpenters and other trade workers to consult with about future repairs

- Bring the following items to the closing table (Your lender may request additional financial information and documentation as a part of the underwriting process)...

- Proof of homeowners insurance

- Money for your down payment and closing costs (Sent via wire transfer from your bank to the office of the attorney who’s handling your closing. As an alternative, you may be able to present a cashier’s check at closing)

- Identification (Driver’s license or Social Security card)

- Loan documents (Closing Disclosure, etc.)

12) Complete post-purchase tasks...

- Budget and plan for moving...

- Create an organized packing system

- Take inventory of your belongings

- Clear out unnecessary items

- Schedule time off from work

- Hire a moving company

- Secure your new home...

- Change the locks & garage codes (You don't want the previous homeowners to still have access to your home)

- Check your carbon monoxide alarms, natural gas alarms, and smoke detectors

- Get familiar with your new home and neighborhood

- Set up safety measures for kids and pets

- Install a security system if necessary

- Update your documents, key accounts and contact information...

- File a change of address form with the Postal Service (You can have mail forward to your new address for up to 3 months)

- Update your information with entities such as...

- IRS (IRS)

- Department of Motor Vehicles (DMV) (Get a new license and register your car)

- Social Security Administration (SSA)

- Banks and credit card companies

- Insurance companies

- Health care providers (Transfer your medical records after identifying a new provider)

- Voter registration

- Employers

- Locate a safe space to store your important documents...

- Closing documents (Save digital copies)

- Social Security Cards

- Birth Certificates

- Passports

- Plan for maintenance and repairs...

- Create an annual maintenance schedule

-

Start your collection of basic tools

- Consider purchasing a home warranty to cover major appliances or systems

-

Find the circuit box, emergency shut-offs, and appliance manuals

-

Create a checklist of future home projects (Start with findings from the home inspection)

-

Schedule any necessary repairs or updates such as refreshing the paint and/or flooring

- Other important tasks...

- Familiarize yourself with your new utility service providers, and schedule your start dates (Water/sewer, electricity and/or gas, trash collection)

- Set up cable & internet service

- Deep clean your new house

If you're ready to start building a financial strategy that works for you, let's talk.

We’ll work together to create a tailored plan designed specifically to conquer your financial challenges and help you learn to manage money like the 1%.

Click the link to schedule a FREE 30-Minute Consultation where we can talk about your goals and see if Spartan Financial Coaching is the right fit for you.

Sources:

https://www.experian.com/blogs/ask-experian/what-is-seasoned-money-for-down-payment/

https://www.rocketmortgage.com/learn/best-home-buying-checklist

https://www.zillow.com/agent-resources/agent-toolkit/first-time-home-buyers-checklist/

https://money.usnews.com/loans/mortgages/articles/a-checklist-for-first-time-homebuyers

https://www.rocketmortgage.com/learn/what-to-do-when-you-move-into-a-new-home

https://www.bankrate.com/real-estate/things-to-do-when-moving-into-a-home/

https://www.redfin.com/blog/things-to-do-after-buying-a-home/