Car Buying Checklist

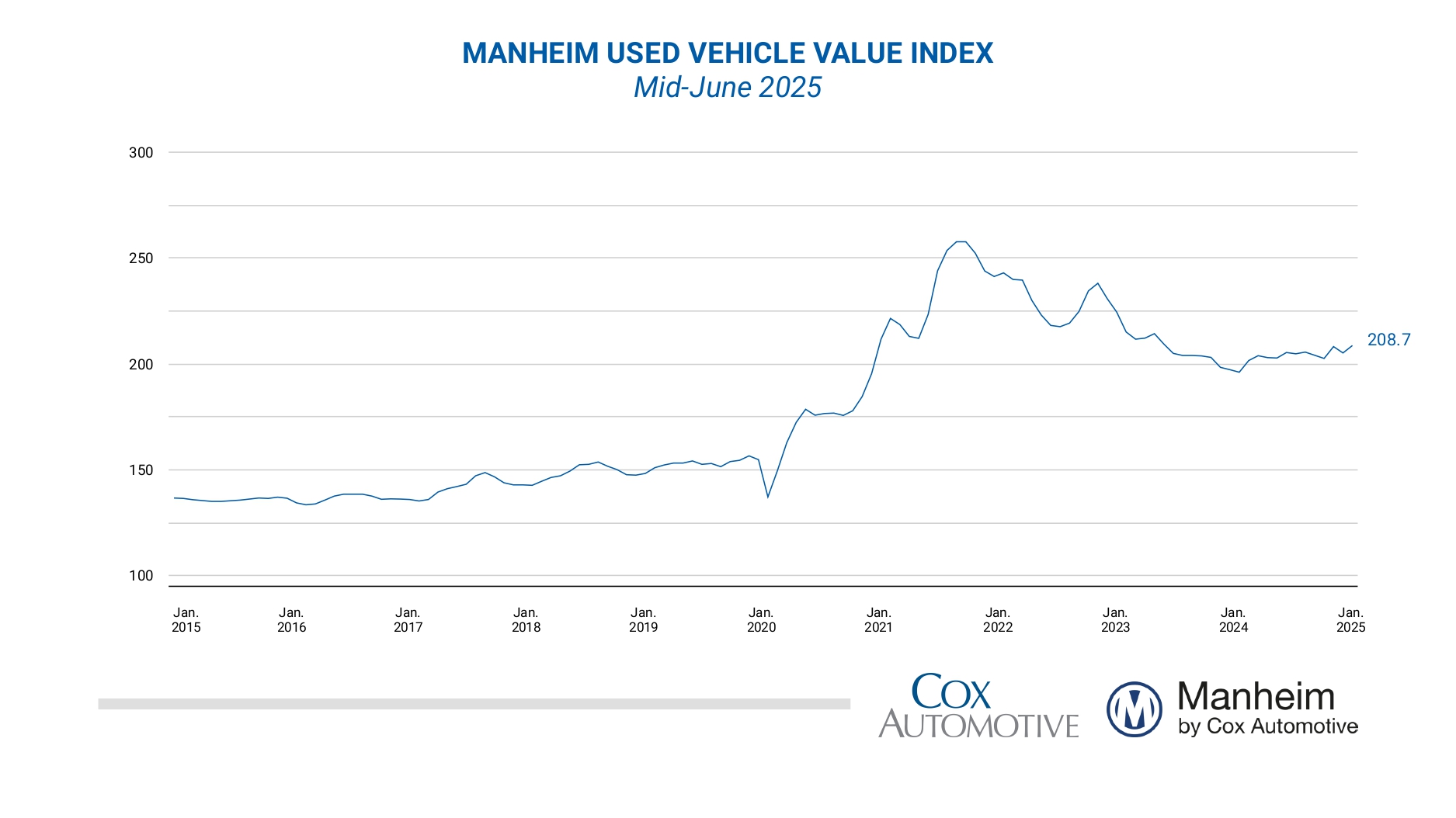

What was once a simple transaction, buying a car has become a major financial decision for many Americans. With vehicles being rapidly depreciating assets, car buying has always required careful consideration. But in today’s environment, where many buyers are still prioritizing style and trends over practicality, the stakes are higher than ever. The car market remains distorted by lasting effects from the pandemic, now amplified by inflation, tariffs, and tight monetary policy. These conditions have led many consumers to overpay or lock themselves into loans that stretch their budgets. Used vehicle prices, for instance, remain inflated by around 42% over pre-pandemic levels:

Source: Used Vehicle Value Index - Manheim

Although prices began stabilizing in 2023, new tariffs on imported vehicles and parts are poised to raise sticker prices by thousands of dollars. Tariffs on core materials like steel and aluminum are also making their way into higher repair costs and elevated insurance premiums. In fact, average full-coverage auto insurance now costs around $2,680 per year, with back-to-back double-digit increases seen in 2023 and 2024.

Meanwhile, buyers are financing more to keep up with rising vehicle costs. As of Q2 2025, the average amount financed for a used vehicle reached approximately $26,144, with loan terms averaging over 67 months. And while banks took a conservative stance on auto lending during the height of the pandemic, lending standards have been loosening again since 2023:

Source: FRED®, Federal Reserve Bank of St. Louis

With easier credit available, more buyers are now carrying auto debt equal to 50% or more of their annual incomes — a threshold that puts significant pressure on household finances. Unsurprisingly, delinquency rates have also risen, reaching levels not seen in years.

While we can’t control the macroeconomic forces shaping today’s car market, we can take practical steps to avoid common financial pitfalls. Many experts recommend purchasing a three-year-old used vehicle to bypass the worst of early depreciation. This is excellent advice — but it’s equally important to conduct thorough research, check the vehicle’s history, and invest in a pre-purchase inspection. If you’re buying new, aim to choose a car you’ll keep for at least 10 years to reduce the long-term cost of ownership. Whether new or used, budget conservatively for maintenance so your car lasts 200,000+ miles. When it comes to financing, gather all necessary documentation ahead of time, compare loan offers, and prioritize shorter loan terms with competitive rates when possible. You may also be able to reduce ongoing costs by switching insurance providers or adjusting your coverage.

To help you navigate the process from start to finish, I’ve created a detailed checklist that breaks down every major step — from understanding your needs to finalizing financing, registration, and long-term maintenance planning. Whether you’re buying soon or just preparing, this guide is designed to help you make the most informed, confident decision possible.

Car Buying Checklist:

1) Determine your needs vs. wants...

- New vs. Used...

- New cars: Warranties, less maintenance, but higher cost and faster depreciation

- Used cars: Lower price, more variety, but check condition/history closely and consider buying certified pre-owned

- Vehicle Type & Usage...

- Type: Sedan, SUV, truck, electric/hybrid, etc.

- Usage: Commuting, family, off-road, towing, etc.

- Other factors: Fuel efficiency, reliability, resale value, safety features, space, technology, etc.

2) Estimate affordability and prepare finances...

- Calculate your ongoing costs of ownership and compare to your monthly income...

- If you plan on financing, start by estimating your monthly loan payments

- Then, estimate the total cost of ownership...

- Loan payments

- Insurance premiums

- Gas

- Maintenance and repairs

- Taxes, registration, and fees

-

- Finally, adhere to the 20/3/8 Rule...

- 20% Down Payment

- 3 Year Loan Term

- 8% of gross monthly income for just the loan payment (Aim to spend less than 10-15% of monthly take-home pay on transportation expenses overall)

- Finally, adhere to the 20/3/8 Rule...

- Estimate your 'out-the-door price' which includes...

- Sales price

- Destination charge (For new cars)

- Sales taxes

- Registration/Title/Documentation fees

- Dealer add-ons and markups (Often listed on a window sticker)

- Optional financial products (Warranties, gap insurance, etc.)

- Check your credit score...

- Pull a free report and correct any errors

- A higher credit score often results in...

- Lower interest rates

- More flexibility

- Better negotiating power

3) Research and shop for vehicles...

- Start with online research...

- Use: Edmunds, CarFax, Consumer Reports, Kelley Blue Book (KBB)

- Compare based on your predetermined criteria

- Search listings on Autotrader, Cars.com, etc.

- Create a short list of cars to move forward with

- Begin in-person shopping...

- Visit dealerships or private sellers

- For used cars, request a vehicle history report

- Test drive cars in various conditions...

- Check acceleration, comfort, controls, visibility, etc.

- Pay attention for engine noise, difficulty braking and handling, etc.

- Optional: Get a trusted mechanic to do a pre-purchase inspection

4) Get preapproved for financing...

- Apply at banks, credit unions, or online lenders once you have a specific vehicle in mind

- Get an auto loan preapproval for the car you want BEFORE visiting the dealership to give yourself more negotiating power when making your purchase

- Be prepared to compare your preapproved loan terms with dealership financing

5) Finalize insurance coverage...

- Gather information...

- Vehicle identification number (VIN)

- Make, model, and year

- Expected purchase date

- Contact your current insurer or shop for quotes

- Add the vehicle to your policy with a future effective date...

- If you're replacing an existing vehicle, you may need to remove the old car from your policy

- There will usually be a grace period where the new car is covered, even if you don't drive it off the lot immediately

- Always inquire about potential discounts for bundling your auto insurance with other policies like home or renters insurance

6) Negotiate the deal...

- Be ready...

- Bring: License, Insurance, Loan pre-approval, Service history checks

- Know the fair market value going in

- Negotiate based on the 'out-the-door price'...

- Decide how much you’re willing to spend all-in (Including taxes and fees)

- Focus on total cost (Not just the monthly payment)

7) Finalize financing and consider add-ons...

- Compare loan terms again...

- See if the dealer beats your preapproved loan terms

- Confirm APR, term, fees, and total cost

- Review dealer add-ons carefully...

- Do they solve a real problem for you?

- Can you get the same thing elsewhere for less?

- The dealer is incentivized to sell high-margin items — not necessarily what’s best for you

- Research the most common dealer add-ons ahead of time (And whether they are worth it)...

- Extended Warranty...

- What it is: Extra coverage after factory warranty expires

- Worth it? Maybe — skip if the car is highly reliable or you don’t plan to keep it long (Shop third-party warranties before saying yes)

- Gap Insurance...

- What it is: Covers the difference between what you owe and what the car is worth if it’s totaled

- Worth it? Yes — but only if you put little down or have a long loan (Usually cheaper through your auto insurer)

- Paint/Interior Protection...

- What it is: Coatings to protect from wear, spills, fading, etc.

- Worth it? Rarely — usually overpriced (You can apply DIY products or ignore altogether)

- Rustproofing/Undercoating...

- What it is: Claims to prevent corrosion and rust

- Worth it? Rarely — modern vehicles already have strong factory rust protection

- Tire/Wheel Protection..

- What it is: Covers damage from potholes, nails, etc.

- Worth it? Maybe — helpful in areas with rough roads, but review the fine print carefully

- Key Replacement...

- What it is: Covers cost of replacing lost or stolen key fobs

- Worth it? Maybe — modern keys are expensive, but this is often overpriced

- Theft Deterrent Systems / VIN Etching...

- What it is: Tracking devices or etching your vehicle's VIN on windows

- Worth it? Rarely — limited value (You can do VIN etching yourself cheaply)

- Prepaid Maintenance Plans...

- What it is: Covers scheduled services like oil changes

- Worth it? Maybe — compare the total cost of plan vs. paying as you go at local shops

- LoJack/Tracking Devices...

- What it is: GPS or radio tracking systems for stolen vehicle recovery

- Worth it? Not usually necessary unless your insurer/lender requires it or you live in a high-theft area

- Extended Warranty...

8) Review and sign paperwork...

- Don’t rush — take your time

- Double-check...

- Purchase agreement

- Loan terms (APR, term, fees)

- Title and registration documents

- Be ready to walk away or take documents home for review

- Check vehicle condition at delivery: Scratches, mileage, included accessories

9) Pay and take delivery...

- Make the down payment (Remember to put down at least 20%)

- Ensure you receive...

- Vehicle Title

- Bill of sale

- Temporary tags or registration

- Owner’s manual and any spare keys (If available)

10) Register the vehicle, get your plates, and plan for ongoing maintenance...

- If buying from a dealership...

- They typically handle paperwork

- You’ll get temporary plates and registration (Permanent ones arrive in 3–6 weeks via mail or pickup)

- If buying from a private party...

- Go to DMV or Tag & Title agent with...

- Vehicle title

- Bill of sale

- Proof of insurance

- Valid ID

- Odometer disclosure (If required)

- Inspection (If required)

- Payment for...

- Registration fee

- Title transfer

- Sales tax

- Plate fee

- Go to DMV or Tag & Title agent with...

- Schedule routine maintenance...

- Stick to a schedule based on mileage

- Keep maintenance records for budgeting purposes and to preserve resale value

If you're ready to start building a financial strategy that works for you, let's talk.

We’ll work together to create a tailored plan designed specifically to conquer your financial challenges and help you learn to manage money like the 1%.

Click the link to schedule a FREE 30-Minute Consultation where we can talk about your goals and see if Spartan Financial Coaching is the right fit for you.

Sources:

https://checklist.com/new-car-checklist

https://www.bankrate.com/loans/auto-loans/checklist-before-buying-car/

https://www.nerdwallet.com/article/loans/auto-loans/the-car-buyers-checklist

https://www.copperstatecu.org/blog/checklist-how-to-buy-a-used-car-with-confidence-free-pdf