Financial Goals for Your 20s

Your 20s are an exciting period that also offer a crucial chance to initiate your long-term financial strategy. This begins with recognizing the most significant financial decisions you can make during this stage of life.

If you're entering the professional world for the first time, your earning power may be limited compared to latter decades. This means hitting certain quantifiable goals—like a target net worth or retirement number—can feel out of reach. Your focus should first shift to conquering foundational obstacles like getting established in your career, paying off debt, and securing stable housing. Start creating a long-term vision and stacking smart, incremental decisions around these early goals. This approach builds both momentum and the proactive mindset you’ll need to face the bigger financial decisions ahead.

Unfortunately, there are many common misconceptions among young people that prevent them from ever getting started. One reason often cited is the desire to fully enjoy their time while they can. While it's true that one cannot exchange wealth for health later in life, it is possible to balance having fun with making the sacrifices necessary to achieve your long-term goals. Whether you're learning to improve from your mistakes, or allowing your investment gains to compound, the most powerful asset you have at your disposal in your 20s is time. You can avoid this truth in the short-term, but it will become increasingly difficult to start thinking strategically as time passes. The advantage of starting as early as possible is illustrated exceptionally well by The Money Guy's “Wealth Multiplier” guide. So while opinions on the best way to spend your 20s may differ, there is no getting around the fact that how you choose to spend them involves inherent trade-offs. Chris Williamson, the creator of the Modern Wisdom podcast, expresses this idea well:

"There's no perfect way to live your 20s. You either live them up and become an under-skilled 30-year-old or you work them up and become an under-lived 30-year-old. You just have to figure out which you'd rather be, accept the trade-offs, and know that there are no do-overs".

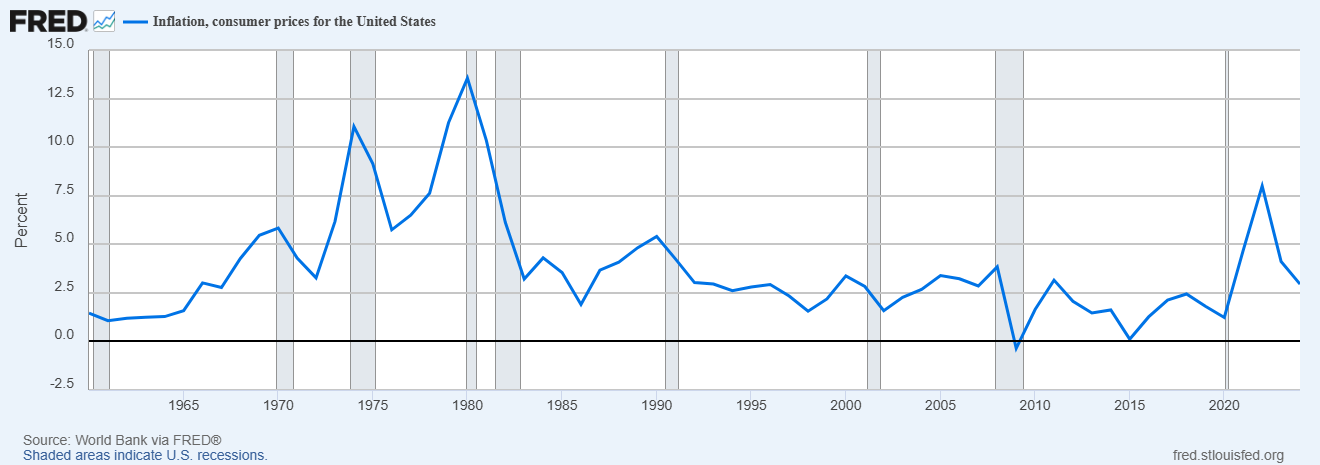

Many also believe it's no longer worth saving or investing for the future due to negative economic forecasts around financial markets, housing affordability, and inflation. Millennials, including myself, feel this deeply. Since the start of the COVID-19 pandemic, inflation has increased over 25%, depending on the data source. The destruction caused by this type of persistently high inflation, far above the Federal Reserve's stated target of 2%, is something that young people haven't had to deal with since the 1970s:

Source: FRED®, Federal Reserve Bank of St. Louis

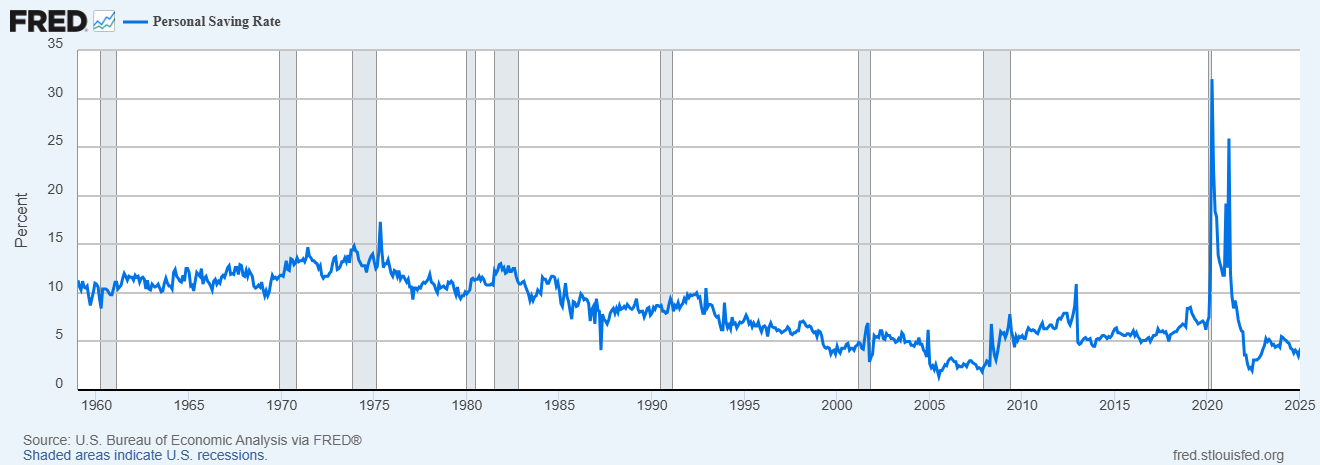

However, rather than learning from previous generations about building and preserving wealth, many have already given up as shown by their spending habits. While annual inflation may have declined since the 1970s, the personal saving rate has been gradually decreasing in tandem. Apart from a short-term surge during the COVID-19 pandemic, due to a variety of abnormal circumstances, savings have now declined to around 4% as of 2025:

Source: FRED®, Federal Reserve Bank of St. Louis

In order to set yourself apart from these trends and build real momentum as you approach your 30s, it is advisable to minimize social media usage and engage in activities that are often overlooked by others. Instead of resenting affluent individuals or previous generations, learn from them as much as possible. Although they may not share the perspective of someone growing up in today's economic climate, residing with parents or relatives for a specified period can be beneficial if feasible. I recognize this isn’t a healthy option for everyone. But in my case, I made a plan to live at home for two years after college, and it was one of the most impactful decisions I made. During that time, I landed my first job, learned to budget, and saved every penny for a down payment on my first home. If you choose to take this route, the only caveat is that you must have a financial plan. Without one, lifestyle creep can trap you in a cycle of dependency—something that’s becoming increasingly common. Regardless of the environment selected, ensure it fosters encouragement to explore various options, and facilitates the discovery of aptitudes. This will aid in making informed decisions once independence is achieved. Journaling about your experiences and sources of happiness can be an invaluable tool in this process. Additionally, for those inclined towards deeper self-analysis, Carl Jung's theory of psychological types offers profound insights into our unique personality traits. Educating oneself on the 16 personality types he identified, and taking an online personality test can be highly informative.

You don't need to be a trained psychoanalyst or have everything figured out when starting your journey. As your confidence grows, your focus should gradually shift to establishing a solid financial foundation. Cultivate a lifelong learning mindset for personal finance, schedule monthly money dates to track progress, and save and invest a portion of your income as you go. The goals outlined below provide realistic targets to aim for as your foundation develops. These efforts require intentionality and perseverance—but they will pay off. By the time most people start getting serious about money in their 30s, you’ll already be ahead—working for your plan, not someone else’s.

Financial Goals for Your 20s:

Debt (& Credit) Goals...

- Build your credit score intelligently...

- Open a secured credit card (Keep utilization below 30% & Pay bills on time)

- Take out an auto loan using the 20/3/8 Rule

- Review your credit periodically and dispute any errors

- Plan to pay off any existing debt with a debt repayment method (Debt Snowball vs. Debt Avalanche), and start using a debt repayment calculator

- Avoid alternative forms of debt such as Buy now, Pay Later plans

- Improve your mindset around consumption vs. saving by cultivating an internal locus of control and shifting the focus of your actions to the completion of at least one long-term goal

- Work on your ability to delay gratification and avoid lifestyle creep...

- Recognize that money and time are finite assets which are being rapidly eaten up by inflation

- Live as far below your means as possible to increase your savings and investing rates

- Don't buy things just to impress other people

Savings Goals...

- Establish an emergency fund containing 3-6 months of expenses, and keep in an interest-bearing account...

- Save $1,000 as a first benchmark

- Save $10,000 as a second benchmark

- Research the savings account options offered by the bank you currently use for convenience OR research popular institutions with competitive rates of interest

- Focus on at least one big savings goal in addition to your retirement savings (Home purchase, Wedding, etc.) to help give you some direction

- Use "The Houdini System" to pay yourself first

- Achieve a savings rate of at least 5% of your gross yearly income (& Increase it by at least 1% every time you get a rasie)

- Start building your savings muscle as early as possible to get ahead of life's inevitable setbacks (Car repairs, Medical emergencies, etc.)

Investing Goals...

- Open up a Roth IRA with a reputable brokerage firm such as...

- Charles Schwab

- Vanguard

- Fidelity

- Start educating yourself about investing and experimenting as early as possible to avoid common mistakes...

- Remember your retirement accounts are a long-term wealth building machine so you should never withdrawal from them early

- Get away from "get rich quick" thinking, and implement tools such as dollar-cost averaging and compound interest calculators

- Learn to manage your cash balance thoughtfully in order to avoid over-investing

- Accumulate investments of 1-3 times your starting salary

- Achieve a net worth over the U.S. median of $7,638 OR aim for the U.S. average of $113,084 if you're over the median

- Understand your options and common guidelines...

- Prioritize simplicity to make your strategy easily repeatable over the long-term

- Broadly diversify based on the level of risk you are comfortable with

- Invest at least half your age as a percentage of your gross income

- Keep your fees as low as possible

- Invest tax-efficiently through...

- Tax-Deferred Accounts (Example: 401(k)) - Many company-sponsored retirement plans have an employer match which practically equates to free money, so determine if your company has one and adjust your contribution percentage to claim it

- Tax-Free Accounts (Example: Roth IRA) - This is a powerful option as the funds invested here are after-tax, so while they will increase your tax burden in the immediate-term, they will grow tax-free for decades until you withdrawal them at age 59 1/2 when you will likely be in a higher tax bracket

Career Goals...

- Get really good at job searching and don't be afraid to switch jobs even every two years if opportunities arise

- Open a 401(k) with your company if available, and make sure to do some due diligence when choosing where the funds are invested (Target date funds are a great option for those who want to simply set it and forget it)

- Build a persuasive case for yourself in order to feel confident when negotiating a raise

- Invest any spare time into yourself and develop skills which are marketable in the age of AI

- Learn to network effectively with...

- Colleagues

- Like-minded individuals (You are the average of 5 people you spend the most time with)

- Mentors ("If they don’t have what you want, don’t listen to what they say." - Alex Hormozi)

Other Goals...

- Make good decisions for your mental and physical well-being...

- Build healthy diet and exercise habits early

- Choose wisely whether to buy or rent where you live

- Vow to be a problem-solver

- Automate your finances to decrease your financial burden...

- Set up automatic transfers from your checking account to your emergency fund account

- Automatically contribute to your investment accounts

- Enroll in autopay for debt payments and bills

- Improve your financial literacy...

- Read my information and consider working with me!

- Curate a list of educational YouTube channels to follow, some of my favorites are...

- Erin Talks Money

- George Kamel

- Humphrey Yang

- Tae Kim - Financial Tortoise

- The Money Guy

- Curate a list of good books to read, some of my favorites are...

- Atomic Habits - James Clear

- I Will Teach You To Be Rich - Ramit Sethi

- The 4-Hour Work Week - Tim Ferriss

- The Millionaire Next Door - Thomas J. Stanley

- The Psychology of Money - Morgan Housel

- Set up a monthly spending plan to...

- Settle into living on less than you make

- Determine your spending habits and where you are overspending

- Start tracking these 4 numbers...

- Fixed costs

- Guilt-free spending

- Savings & Long-term Investments

- Start tracking the following 8 numbers annually...

- Savings Rate

- Investing Rate

- Monthly Income (Gross & Net)

- Monthly Expenses

- Debt-to-Income Ratio

- Net Worth

- Checking Account Balance

- Savings Account (Emergency Fund) Balance

If you're ready to start building a financial strategy that works for you, let's talk.

We’ll work together to create a tailored plan designed specifically to conquer your financial challenges and help you learn to manage money like the 1%.

Click the link to schedule a FREE 30-Minute Consultation where we can talk about your goals and see if Spartan Financial Coaching is the right fit for you.